For many people, trading doesn’t become difficult because of a lack of tools or market access. It becomes difficult when real money is involved, and decisions start to carry emotional weight. Fast-moving charts, sudden price swings, and the pressure to act quickly can push traders into choices they did not fully plan for.

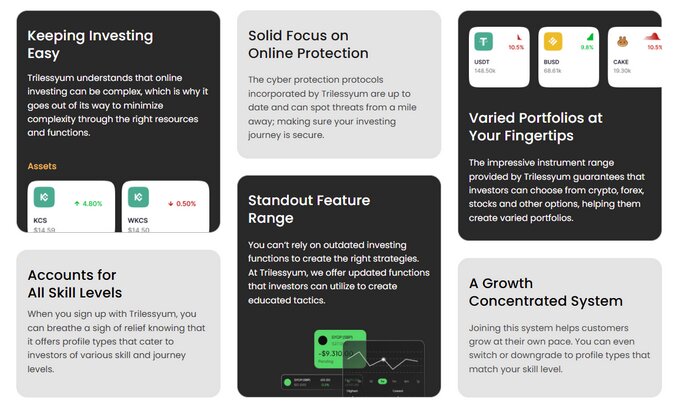

This Trilessyum.com Review looks at the platform from that everyday trading perspective, focusing on how it helps users slow things down and stay organized. Rather than encouraging constant activity, Trilessyum is structured around preparation, risk awareness, and steady decision-making.

Its layout, account options, and built-in tools reflect an approach that prioritizes control and consistency over speed, making the trading experience feel more manageable over time.

Interface Design and Navigation Explained

The trading interface on Trilessyum is designed to remain clear and accessible, even during active market conditions. Charts, order placement tools, and account metrics are presented in a balanced layout that avoids visual overload. This allows traders to focus on decision-making instead of navigating complex menus.

According to this Trilessyum.com Review, the platform’s navigation prioritizes efficiency. Traders can move between asset classes, account settings, and educational resources with minimal friction. This is especially relevant during volatile periods when delayed execution or confusion can lead to unnecessary mistakes.

The interface does not attempt to impress through excessive customization by default. Instead, it offers a stable foundation that supports both new and experienced users without forcing complexity too early.

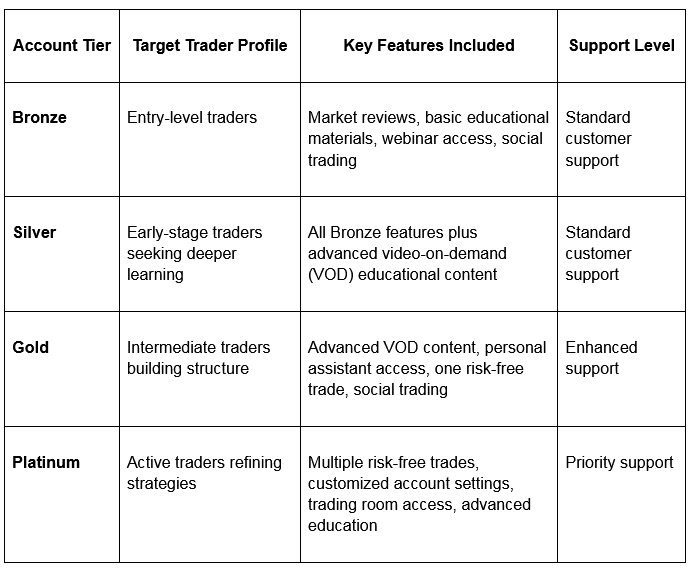

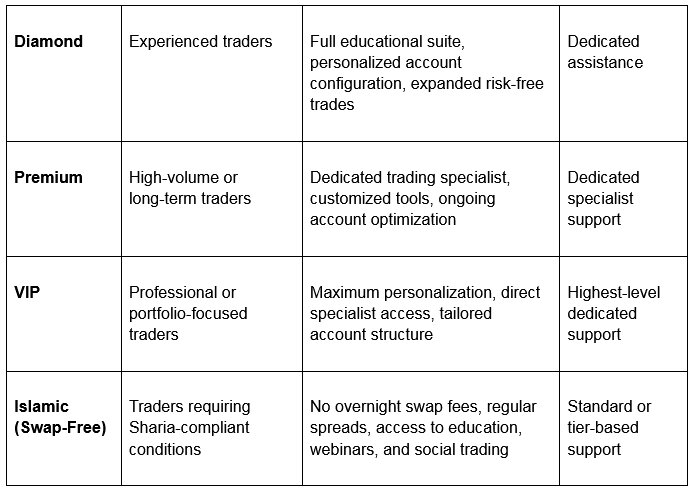

Trilessyum Account Types Overview

Account Structure Summary

Trilessyum’s account system is designed around gradual progression rather than feature restriction. Core tools such as market insights, education, and social trading are available from the entry level, while higher tiers focus on personalization, strategic support, and account optimization. This structure allows traders to select an account that aligns with their experience, activity level, and trading objectives without unnecessary complexity.

How Is Risk Control Handled During Trade Execution?

Risk control is a defining theme throughout the platform. Rather than treating risk management as an optional add-on, Trilessyum integrates exposure awareness directly into the trading process. Before trades are placed, users can clearly see margin requirements and position sizing implications.

This Trilessyum.com Review notes that built-in margin alerts notify traders when equity levels approach critical thresholds, allowing time for corrective action. In addition, negative balance protection ensures that losses cannot exceed the funds available in the account, even during fast-moving market events.

These safeguards encourage traders to plan entries and exits carefully, reinforcing disciplined behavior rather than impulsive reactions.

Social Trading as a Practical Learning Tool

Social trading is another feature examined in this Trilessyum.com Review, though its role extends beyond simple trade replication. Traders can follow and mirror the actions of others with established track records, but the platform’s real value lies in transparency.

By observing how experienced traders select assets, manage timing, and size positions, newer participants gain practical insight into real trading behavior. This exposure can help bridge the gap between theoretical learning and live execution.

When used responsibly, social trading serves as a reference point rather than a shortcut, supporting education and self-development instead of dependency.

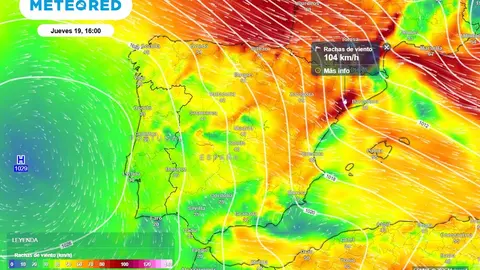

How Trading Sessions Shape Market Activity?

Trilessyum supports multiple asset classes, including forex, CFDs on stocks, commodities, and cryptocurrencies. Each market operates within its own trading schedule, and understanding these patterns is essential for effective participation.

Forex markets remain active throughout the weekday cycle, with higher liquidity during overlapping sessions such as London and New York. Equity CFDs follow the hours of their respective exchanges and remain inactive on weekends. Commodities trade during defined weekday windows, while cryptocurrencies remain accessible around the clock.

As outlined in this Trilessyum.com Review, traders who align activity with periods of higher volume often experience clearer price movement and smoother execution.

Educational Content and Skill Building

Education is integrated into the platform rather than isolated as a separate feature. Learning resources include written materials, webinars, and video-based content that expand in depth depending on the account tier.

This Trilessyum.com Review highlights that educational materials focus on understanding market behavior, managing risk, and building structured trading routines. Rather than emphasizing outcomes, the content encourages process-driven thinking.

Higher-tier accounts gain access to more advanced resources and personalized explanations, supporting traders as their experience and responsibilities increase.

Trading Psychology and Behavioral Support

Emotional discipline plays a critical role in trading performance, even though it is often overlooked. Fear, overconfidence, and hesitation can undermine otherwise sound strategies.

Trilessyum addresses these challenges indirectly through platform design. Clear exposure displays, predefined risk parameters, and structured trade previews encourage traders to think before acting. This Trilessyum.com Review observes that such features help reduce impulsive decisions during volatile conditions.

By reinforcing routine and planning, the platform supports steadier behavior without attempting to automate emotional control.

Islamic Account Availability

For traders seeking swap-free conditions, Trilessyum provides an Islamic account option. This account structure removes interest-based overnight charges while maintaining access to core platform features such as market analysis, educational resources, and social trading.

Spreads remain consistent with standard accounts, ensuring functionality is not reduced. As noted in this Trilessyum.com Review, the availability of this option reflects flexibility without fragmenting the overall trading experience.

How Support Evolves With Account Level?

Support on the platform is structured to grow alongside the trader. All account holders can access general customer assistance for technical questions and platform-related issues. As traders progress to higher account tiers, support becomes more personalized, with the option to work with personal assistants or dedicated trading specialists.

These professionals focus on helping users understand platform features, organize their accounts, and develop structured trading approaches rather than offering direct trade recommendations. This Trilessyum.com Review shows that the support model adapts naturally to trader experience, providing guidance when it becomes relevant without creating dependency during earlier stages.

Overall Perspective

This Trilessyum.com Review presents a platform that emphasizes structure, planning, and controlled progression over aggressive features or promotional claims. The tiered account system, integrated risk tools, educational focus, and scalable support work together to create a measured trading environment.

Trilessyum does not attempt to redefine trading outcomes, but it does emphasize how traders interact with the process itself. By focusing on structure and measured decision-making, the platform provides an environment that aligns with disciplined trading approaches. For those who prioritize clarity and long-term participation over short-term momentum, its framework may serve as a practical reference point.